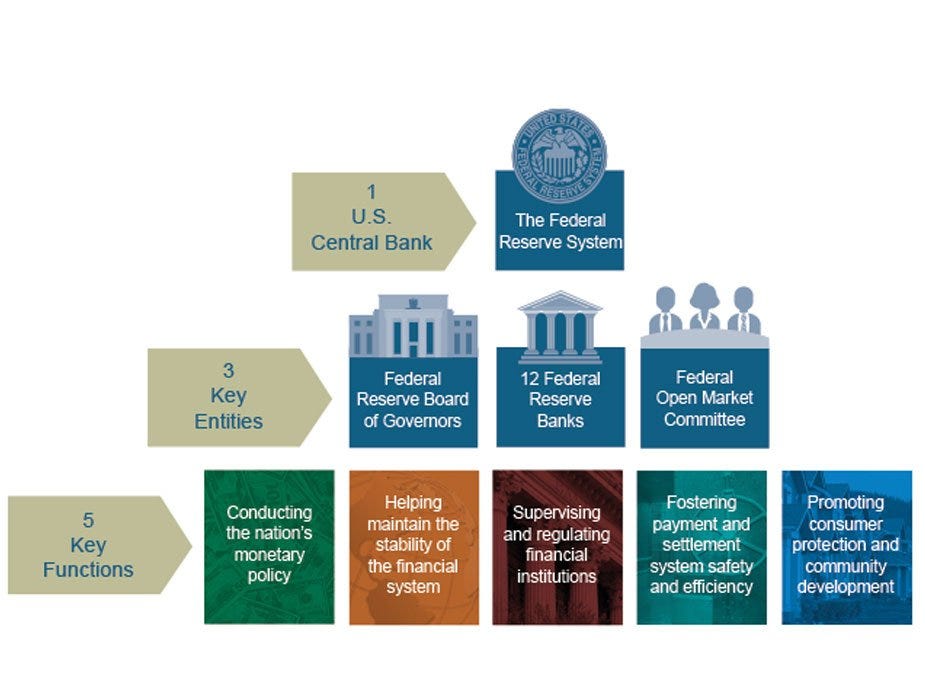

In 1913, the Federal Reserve was established to prevent financial panics with oversight and intervention. The Fed didn’t become an independent from executive branch control until the Fed-Treasury Accord was passed by Congress in 1951 (during the Truman presidency).

Today, AI systems are progressively deployed to manage financial markets and predicting economic shifts. This posits an intriguing possibility: Could a DAO (Decentralized Autonomous Organization) - powered by AI, governed by code and hard-economic data - serve as the central bank for a U.S. Digital Currency?

A primer on DAOs: Organizations run by code

A DAO (daʊ or D-A-O), Decentralized Autonomous Organization, is essentially an organization that runs on code rather than human management. The rules and regulations for it are written in smart contracts – self-executing programs that automatically enforce agreements. It is a digital organization where every rule, decision, and transaction is transparent, accountable, and automated.

The first major DAO, called The DAO, launched in 2016, raising $150 million for a community-managed investment fund. While that particular experiment ended due to technical vulnerabilities, it changed how some people think about organizational governance. Today, DAOs are capable of managing everything from investment funds to social clubs, with members using digital tokens to vote on decisions that are then executed automatically. As-of-writing this, only Tennessee, Wyoming, and Vermont (as a BBLLC) recognize DAOs as legal entities.

Why does this matter for central banking? Because DAOs represent something groundbreaking: organizations that can operate continuously, transparently, and without human bias. Every decision is driven by pre-set rules and data, not politics or personal judgment.

A Tale of Two Currencies

Imagine two parallel financial universes. In one, we have our familiar dollar, backed by the full faith and credit of the U.S. government and managed by the Federal Reserve's complex human-driven system. In the other, we have a digital dollar, governed by smart contracts and AI, operating with mathematical precision.

The traditional dollar lives in a world of fractional reserve banking, where decisions flow from committee meetings and policy adjustments can take months to impact the economy. It's a system built on human judgment, institutional trust, and careful deliberation.

In contrast, the digital dollar exists in a blockchain-based infrastructure where every transaction is transparent and traceable. Policy decisions are executed programmatically, responding to real-time economic indicators without the lag of human deliberation. This isn't science fiction - it's already happening in smaller, experimental systems around the world.

The Heart of Monetary Policy

Both systems would obey the same dual mandate: maximum sustainable employment and price stability.

Their approaches will be wildly different.

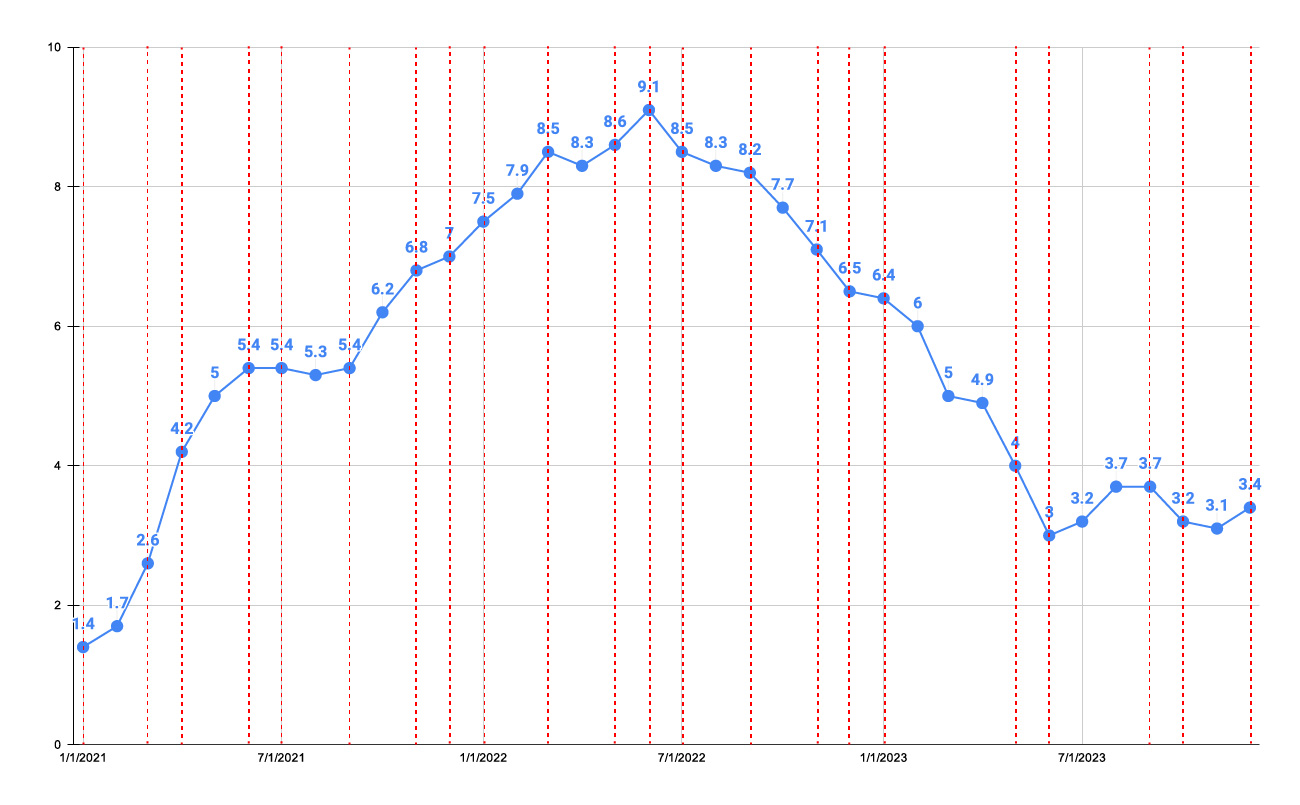

Consider price stability. The Fed uses interest rate adjustments and Open market operations, tools that have served well but can be slow to implement and impact the economy. The 2022 inflation surge illustrates this challenge: while traditional systems were initially debating whether inflation was transitory, it ultimately reached 9.1% by June 2022 - the highest rate since 1981. This surge came from multiple converging factors: supply chain disruptions, stimulus spending, pent-up consumer demand, labor shortages, and energy price spikes.

An AI-driven DAO could adjust digital currency supply algorithmically based on real-time economic indicators, potentially preventing inflation before it takes hold rather than responding to it after the fact. Instead of waiting for quarterly reports and committee meetings, it could process thousands of real-time data points - monitoring supply chain bottlenecks, tracking stimulus effects, analyzing labor market tightness, and observing energy market disruptions - to detect structural changes in the economy as they emerge.

Independence and Transparency Makes Better Capitalism

Capitalism thrives on independence and transparency. Without these principles, markets can devolve into cronyism where insider relationships and political favors trump market forces - a scenario that ultimately harms economic growth and social welfare. Independent oversight and transparent operations aren't just nice-to-haves; they're essential safeguards that keep markets functioning fairly and efficiently.

The Federal Reserve works to embody these principles since gaining its independence in 1951. FOMC meeting minutes are made public, economic data is accessible to anyone, and the Beige Book - published eight times per year - provides ground-level economic insights and anecdotes gathered from businesses across all twelve Federal Reserve Districts. This commitment to transparency helps the public understand how the Fed pursues its dual mandate of price stability and maximum employment. The Fed's decision-making process, while deliberate, is documented and open to scrutiny.

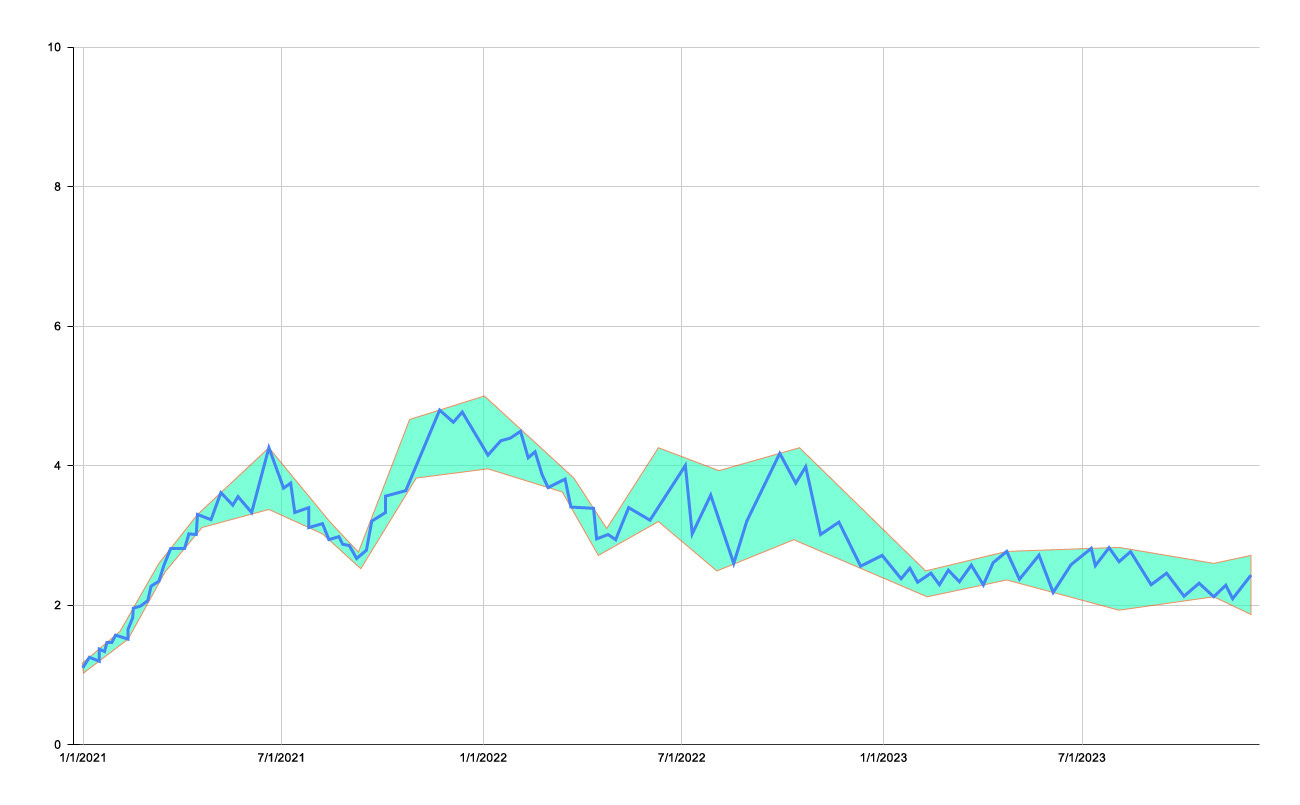

A DAO/AI system takes these principles further by encoding them directly into its architecture. Its publicly accessible codebase eliminates ambiguity - there's no need to interpret meeting minutes when you can read the exact decision-making logic. Instead of quarterly surveys, it processes real-time industry and macroeconomic data continuously. Perhaps most importantly, its ability to make frequent, small adjustments creates an inherently self-correcting system. If a decision proves suboptimal, the system can detect this through incoming data and adjust course accordingly. Unlike human systems that might stick to a wrong course due to institutional inertia or reputational concerns, the DAO responds purely to data. The system learns from every decision, building a transparent track record of actions and outcomes that helps refine its future responses.

It's all about machines working with other machines

For people, I cannot think of a compelling use case for the digital currency that isn’t already satisfied by systems supplying Greenbacks. We can get instant bank transfers, clearinghouses validate transactions in the market, Federal funds, and many other supporting systems and agencies. This is a system is built by humans for humans.

However, for AI-based systems and machines, digital currency isn't just useful - it's transformative. Here's why: machines operate at speeds and scales that today’s banking systems simply weren't designed to handle. Let's look at some emerging use cases where machine-to-machine digital currency becomes essential:

Autonomous Supply Chains

Imagine a smart factory that doesn't just manufacture products - it manages its entire supply chain automatically:

Systems and software negotiate and instantly pay for raw materials based on real-time demand.

Machinery automatically orders and pays for its own maintenance and replacement parts

Inventory systems make independent purchasing decisions, optimizing stock levels dynamically

IoT Economy

The Internet of Things (IoT) is a network of physical devices - from sensors to vehicles to toasters - embedded with electronics to connect, collect, and exchange data. These connected devices need an autonomous financial system to operate at machine speed:

Self-driving vehicles handling their own fuel, maintenance, and toll payments.

Smart city sensors purchasing cloud computing resources as needed.

Environmental monitoring systems automatically deploying and paying for additional sensors based on data needs.

AI Service Marketplace

As systems march to becoming fully autonomous also benefit:

Machine learning models purchasing computing resources on demand

AI agents paying for API access and data services

Automated systems trading specialized datasets

Neural networks renting additional processing power during peak loads

Conclusion

The machine economy demands capabilities that far exceed traditional banking infrastructure. It requires sub-second end-to-end transaction speeds to match the pace of automated decision-making. These transactions must be both programmatic and decisive, leaving no room for ambiguity or interpretation. Every action needs to be transparent and verifiable, creating an auditable trail of machine-to-machine interactions. And perhaps most critically, contracts must execute automatically when conditions are met, without waiting for human approval or oversight.